Table of Contents

- What's Changing in Switzerland's Road Toll System for Commercial Vehicles in 2024?

- Switzerland HGV Truck Toll Price Table 2024 (LSVA)

- Switzerland New Road Toll System Details in 2024

- Who Can Hauliers Partner with for the New SET/EETS System?

- What is the LSVA?

- Difference between LSVA III and LSVA II?

- How Does the New System (LSVA III) Apply to Domestic and Foreign Vehicles?

- How to Calculate Switzerland 2024 Truck Toll Changes?

As we step into 2024, Switzerland is ushering in significant changes in its truck toll regulations. In this article, we'll break down the key updates in the 2024 Switzerland Truck Toll Tariff Table, focusing on the new electronic vignette and the evolving landscape of performance-based heavy vehicle charges.

For more information, visit https://www.bazg.admin.ch/bazg/de/home.html.

1. What's Changing in Switzerland's Road Toll System for Commercial Vehicles in 2024?

Big changes are happening in Switzerland's commercial vehicle toll collection, starting in 2025. They're adopting the SET/EETS telematics system to automate operations. This high-tech upgrade aims to reduce border waiting times, minimize mistakes with automated toll collection, and enhance efficiency. Truck hauliers must sign contracts with a SET service provider and equip trucks with the necessary on-board gear to integrate into the new telematics system.

Since December 1, 2023, the 2024 electronic vignette has been active on Swiss roads. Accessible through www.e-vignette.ch on the "Via Portal '' by the Federal Office for Customs and Border Security (FOCBS), this digital pass automated toll collection, making it more efficient.

Before you check out the tariff table for Switzerland truck tolls 2024, you should know:

- LSVA (Leistungsabhängige Schwerverkehrsabgabe) is the federal tax at play.

- Considerations include total weight, emission levels, and kilometers traveled.

- Applicable to vehicles with a weight over 3.5 tonnes, transporting goods, and using Swiss public roads, both domestically and internationally.

Wondering how IMPARGO can help your business?

Ask us or sign up for a free trial. Let's simplify your trucking with IMPARGO!

2. Switzerland HGV Truck Toll Price Table 2024 (LSVA)

For a detailed look at toll charges in 2024, turn to the Levy Rates Table under "LSVA - General information / Tariffs."

| Submission Category | Euro category | Tariff |

| I | Euro 0 to 5 | 3.10 Ct./tkm |

| II | - | 2.69 ct./tkm |

| III | Euro 6 | 2.28 ct./tkm |

No more discounts for vehicles with particulate filters.

| Decisive weight | 18 t |

| Tariff according to issue (Euro 6) | 2.28 ct./tkm |

| Mileage | 100 km |

| Total (18 x 2.28 x 100 = 4105) | CHF 41.05 (incl. |

Disclaimer: The truck toll rates table for Switzerland in 2024, available here, is provided for general information purposes only. It is not binding, and users are advised to verify details independently. The information may not be up-to-date, and users should consult official sources for the latest and most accurate data. The FOCBS and its operators are not liable for any reliance on the information contained in the table.

Click here to access all official documents for the road charge in Switzerland.

3. Switzerland New Road Toll System Details in 2024

A. Articulated Motor Vehicles / Semi-Trailers

For articulated motor vehicles registered as a unit, the toll is calculated based on the total weight of the unit. However, if semi-trailers are registered separately, the unladen weight of the semi-trailer and the total weight of the semi-trailer become crucial in determining the levy.

B. Exceptions for Switzerland Heavy Truck Toll 2024

Certain domestic and foreign registered vehicles enjoy exemptions from the toll. These include:

- Military vehicles with military or civilian license plates and an M+ sticker.

- Vehicles of the police, fire, oil and chemical brigades, civil defense, and ambulances.

- Vehicles used for licensed passenger transport.

- Agricultural vehicles with green license plates.

- Vehicles with Swiss day plates.

- Improperly registered vehicles with dealer plates.

- Driving school vehicles, provided they are used exclusively for driving school purposes and enrolled by a registered driving school.

- Veteran vehicles as designated in the vehicle registration document.

- Motor vehicles with electric drive.

- Caravans and goods transport trailers for showmen and circuses.

- Crawler-type vehicles.

- Transport axles.

- On prior request to the Federal Office for Customs and Border Security: Journeys for humanitarian or non-profit, non-commercial reasons.

C. Refunds for Switzerland Tolls and Benefits

Special regulations apply to certain vehicles and transports, including journeys in unaccompanied combined transport, transport of raw timber, transport of open milk, and transport of farm animals.

D. How to Use Emotach Toll Detection Device for Switzerland Truck Tolls 2024

The Emotach toll detection device is a key player in the toll collection process. The emotachSimulator serves as an interactive training program, allowing drivers and vehicle owners to familiarize themselves with operating the LSVA detection device (emotach). For more details, visit www.emotachsimulation.ch.

E. Switzerland Customs Tariff Changes January 2024

Abolition of Industrial Tariffs: The removal of industrial tariffs is a key aspect of the Customs Tariffs Changes. This move reflects an effort to streamline and simplify the tariff structure for industrial products.

Simplification of Tariff Structure: The restructuring aims to make the tariff system more straightforward, facilitating a clearer understanding of customs duties for industrial goods.

Information Updates: For all the latest and pertinent information on these changes, the Federal Office for Customs and Border Security (FOCBS) provides updated details. Subscribers can expect to receive electronic notifications, ensuring they stay informed about the modifications.

Last update: 27.12.2023 (documents with older date are unchanged)

| Simplification of the Customs Tariff 1.1.2024 | 01.01.2024 (XLSX, 2 MB, 29.03.2022) | File description (PDF, 88 kB, 07.07.2023) | |

| Concordance list tariff numbers 2024↔2022 | 01.01.2024 (XLSX, 191 kB, 07.07.2023) | ||

| Concordance list 2024 tariff number/key old-new | 01.01.2024 (XLSX, 527 kB, 05.10.2023) | ||

| Tariff structure | 01.01.2024 (XLSX, 1 MB, 07.07.2023) | File description (XLS, 40 kB, 01.01.2024) | |

| Tariff Numbers | 01.01.2024 (XLSX, 225 kB, 11.07.2023) | File description (XLS, 24 kB, 17.10.2011) | |

| Key Structure | Import (XLSX, 237 kB, 15.12.2023) valid from: 1.1.2024 | Export (XLSX, 152 kB, 15.12.2023) valid from: 1.1.2024 | File description (XLS, 39 kB, 01.01.2024) |

| Statistical Keys | Import (XLSX, 102 kB, 15.12.2023) valid from: 1.1.2024 | Export (XLSX, 76 kB, 15.12.2023) valid from: 1.1.2024 | File description (XLS, 27 kB, 25.08.2010) |

| Combined tariff and key structure | 01.01.2024 (XLSX, 1 MB, 07.07.2023) | File description (XLS, 44 kB, 07.07.2023) | |

| Tariff rates (Ch. 1-30) | Import (XLSX, 11 MB, 27.12.2023) valid from: 1.1.2024 | Export: no customs duties | File description (XLS, 45 kB, 25.04.2019) |

| Customs duties (Ch. 31-63) | Import (XLSX, 11 MB, 18.08.2023) valid from: 1.1.2024 | Export: no customs duties | |

| Tariff appropriations (Ch. 64-83) | Import (XLSX, 6 MB, 18.08.2023) valid from: 1.1.2024 | Export: no customs duties | |

| Tariff rates (chapters 84-97) | Import (XLSX, 11 MB, 18.08.2023) valid from: 1.1.2024 | Export: no customs duties | |

| Authorisation requirement | Import (XLSX, 1 MB, 14.12.2023) valid from: 1.1.2024 | Export (XLSX, 910 kB, 14.12.2023) valid from: 1.1.2024 | File description (XLS, 56 kB, 01.01.2024) |

| Additional levies | Import (XLSX, 2 MB, 14.12.2023) valid from: 1.1.2024 | Export: no additional duties | File description (XLS, 48 kB, 20.03.2013) |

Non-Customs Decrees | Import (XLSX, 910 kB, 14.12.2023) valid from: 1.1.2024 | Export (XLSX, 709 kB, 14.12.2023) valid from: 1.1.2024 | File description (XLS, 42 kB, 18.10.2011) |

| Customs facilitation | 01.01.2024 (XLSX, 138 kB, 11.07.2023) | File description (XLS, 38 kB, 15.12.2021) | |

| General rate | 01.01.2024 (PDF, 8 MB, 11.09.2023) | ||

| Questions & Answers (FAQ) | SECO - State Secretariat for Economic Affairs | Abolition of industrial tariffs (admin.ch) | |

The data contained in the files are non-binding. In any case, the texts and dates of the legal decrees are decisive.

F. Switzerland New Customs VAT Rates from January 2024

Effective from January 1, 2024, there will be modifications to Switzerland's VAT rates as outlined below:

| Until December 31, 2023 | New from 1 January 2024 | |

| Standard rate | 7.7 % | 8.1 % |

| Reduced rate | 2.5 % | 2.6 % |

Starting from January 1, 2024, new tax rates of 8.1% and 2.6% will be applicable to all imported goods for which the import tax liability arises on or after this date. The import tax liability aligns with the customs debt, as specified in Article 56 of the VAT Act (Article 69 of the VAT Act). It's important to note that due to technical constraints, periodic collective filings can only use the previous tax rates until December 31, 2023. If a collective declaration is missed in the previous year, and the importer can't deduct the full input tax, they should reach out to the local authorities for assistance.

4. Who Can Hauliers Partner with for the New SET/EETS System?

Hauliers, with the new SET/EETS system in play, partnering smartly is crucial. Consider teaming up with authorized SET service providers like Telepass, Toll4Europe, and Axxès. More providers are getting approved too. If you're already using SET in other European countries, extend it to cover Switzerland.

5. What is the LSVA?

The current system for collecting charges from heavy vehicles, known as LSVA II, will be replaced by LSVA III, and this change needs to be done by the end of 2024. Learn more about it here.

6. Difference between LSVA III and LSVA II

New System (LSVA III) Concept

LSVA III brings a game-changing concept compared to LSVA II. In the older system, LSVA II, the emphasis was on specifying and acquiring recording devices. Now, with LSVA III, there's a shift.

It redefines the data needs and quality expectations, turning mileage recording into a service. This change allows for flexibility and innovation from private providers, adapting quickly to the latest technological advancements. It's a more dynamic and responsive approach.

A. Performance-Related LSVA:

Nature of Tax: The LSVA (Heavy Vehicle Charge) is a tax directly tied to the performance of a vehicle.

Calculation Basis: It is calculated based on the total weight, emission level, and kilometers driven in Switzerland and the Principality of Liechtenstein.

Applicability: LSVA is applicable to all motor vehicles and their trailers with a permissible total weight exceeding 3.5 tonnes. These vehicles are used for transporting goods both within Switzerland and internationally.

B. Flat-Rate PSVA:

Nature of Tax: The PSVA (Flat-Rate Heavy Vehicle Tax) is a fixed tax not dependent on specific performance metrics.

Applicable Vehicles: PSVA is imposed on specific vehicle types, including heavy passenger cars, motorhomes, vehicles for passenger transport, tractors, and motor carts.

Tax Structure: Unlike LSVA, PSVA is a flat-rate tax, meaning it is a fixed amount not influenced by factors like weight, emissions, or distance traveled.

For more detailed information about LSVA and PSVA, you can refer to this link.

7. How Does the New System (LSVA III) Apply to Domestic and Foreign Vehicles?

Under LSVA III, a new approach is taken for both domestic and foreign vehicles, introducing two collection services for mileage recording:

NETS (National Electronic Toll Service):

- Provided by the government, NETS is a national electronic toll service.

- Domestic vehicle owners can use NETS for free without needing to install a recording device in an authorized workshop.

- Other providers can join NETS, but approval from the Federal Office for Customs and Border Security (FOCBS) is required.

EETS (European Electronic Toll Service):

- Operational in Switzerland since the beginning of 2021, EETS aligns with the LSVA III concept.

- EETS serves as the primary registration service for foreign vehicles, gradually replacing the old manual system with border terminals.

- In the future, domestic vehicles can also use EETS, provided that their service is approved by FOCBS before being offered for LSVA.

8. How to Calculate Switzerland 2024 Truck Toll Changes?

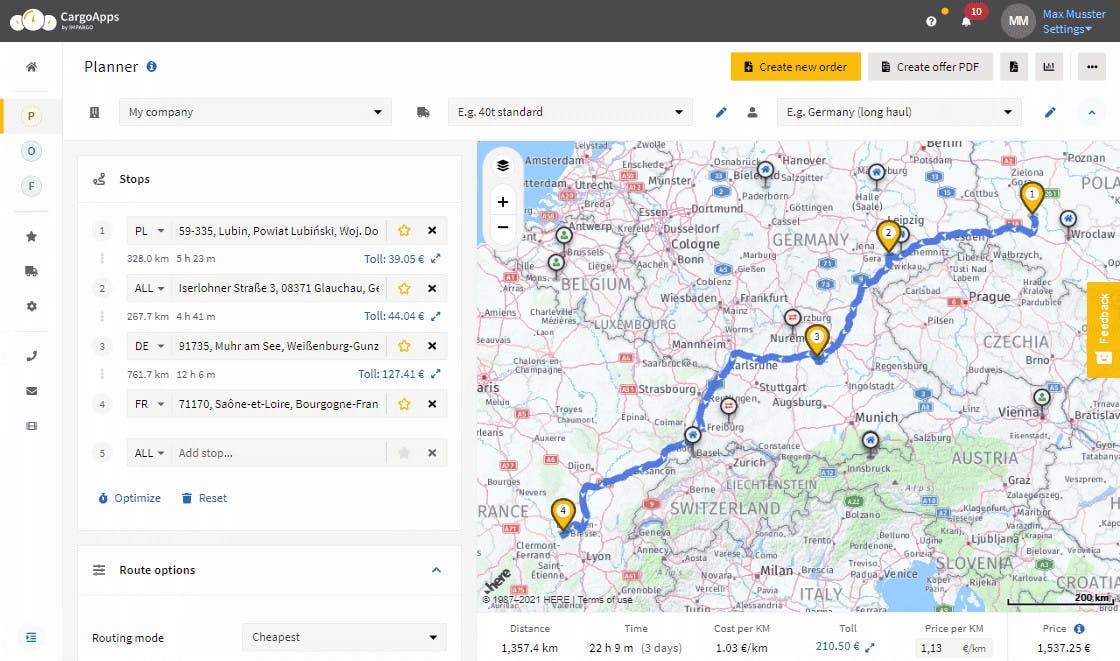

IMPARGO can really help transportation businesses when they team up with authorized service providers like Telepass, Toll4Europe, and Axxès under the new SET/EETS system. This partnership makes IMPARGO even more powerful in managing tolls, planning the best routes, and ensuring smooth transportation. By working together, IMPARGO takes advantage of the SET/EETS system's benefits, such as better accuracy, less waiting time at borders, and easier toll collection. This collaboration brings more efficiency, digital tools, and a competitive edge to transportation businesses.

IMPARGO emerged as a reliable Transportation Management Platform (TMP®), offering tailored solutions for various trucking needs during toll changes in Europe.

Long-Haul Trucking

Solution: Utilize IMPARGO's GPS tracking for trucks and route optimization features for efficient navigation across long distances. The system considers factors like traffic, road closures, and truck restrictions to plan the most optimal routes.

Short-Haul Trucking

Solution: IMPARGO's route optimization and real-time tracking features can be used for effective local distribution. Drivers can receive optimized routes for shorter distances, ensuring timely and efficient deliveries within a specific region.

Refrigerated Trucking

Solution: IMPARGO offers clear communication input for dispatchers and drivers, along with GPS tracking for trucks and live order status updates. While IMPARGO does not have specific temperature monitoring, effective communication and real-time tracking contribute to efficient planning, ensuring that dispatchers and drivers are well-informed throughout the journey.

Flatbed Trucking

Solution: IMPARGO's route planning considers the specific requirements of transporting large or heavy items. Additionally, the system provides real-time visibility, allowing for better coordination and management of flatbed truck movements.

Tanker Trucking

Solution: IMPARGO's GPS tracking and route optimization features can be customized to accommodate the unique needs of tanker trucks. The system ensures safe and efficient transportation of liquids or gases.

Bulk Haulage

Solution: IMPARGO's route optimization helps plan routes suitable for bulk haulage, considering factors like load capacity and efficient loading/unloading. The system enhances the management of bulk material transport.

Container Trucking

Solution: IMPARGO supports the management of container transport with features like real-time tracking and route optimization. The system aids in the seamless movement of standardized cargo containers between different locations.

Specialized Transport

Solution: IMPARGO's customizable features can be adapted for transporting specialized goods. The system allows for dynamic route changes, ensuring the safe and secure movement of hazardous materials, oversized loads, or fragile goods.

Parcel and Courier Services

Solution: IMPARGO's last-mile optimization ensures efficient delivery in urban areas. The system provides real-time tracking for smaller trucks or vans used in parcel and courier services.

Express Freight Services

Solution: IMPARGO's route optimization and real-time tracking are crucial for time-sensitive express freight services. The system facilitates quick and reliable transportation, meeting tight delivery schedules.

You can request a demo and ask about our solutions for your own transportation business.

Don't miss the opportunity to digitize your transportation management and gain a competitive edge in the market. Explore additional solutions at IMPARGO Transport Management Platform for road freight logistics.